Starting an eCommerce beauty brand seems glamorous. There are famous celebrities like Kylie Jenner successfully selling their own beauty line for hundreds of millions of dollars. There’s influencers showcasing their favorite makeup, mascara and skincare generating tens of thousands of likes and shares. Looks can be deceiving. Starting a successful eCommerce beauty brand is hard work.

I’m going to tell you what it takes to start a successful eCommerce beauty brand based on my experience in the skincare and beauty space. After reading this article, you’ll know all the necessary steps to launch your own beauty brand. From creating a product and brand to marketing your beauty line, there’s a lot of work and money involved.

eCommerce Beauty Growth

The share of overall retail for eCommerce more than doubled from 2017 to 2021 [source]. Retail ecommerce sales in the US will see steady growth over the next several years, maintaining an increase of more than 10% every year from 2024 through 2027 [source].

One category that’s leading the way in eCommerce growth is the beauty industry, which is up from $483B in 2020 to $511B in 2021 [source]. In 2023, revenue for the beauty and personal care market amounts to $579 billion and is expected to grow by 3.53% annually [source].

I encourage you to read these 22 eCommerce beauty statistics and trends to better understand the growth of this sector.

TikTok, Instagram, Twitter and Facebook are more popular now than ever, meaning the beauty products people use are more visible now than ever. Now it’s time to formulate a plan for your eCommerce beauty brand.

What Makes Me an eCommerce Beauty Expert?

I’m the Co-Founder of DermWarehouse.com, one of the largest dermatologist owned skincare sites. After selling hundreds of brands of professional strength skin care and beauty products to over 400,000 customers, I learned the ropes when it came to the eCommerce beauty industry. I saw what it took for brands to grow and succeed, I learned what kind of products people liked and disliked (and why) and most importantly, I learned the ins and outs of running an eCommerce operation. This is what led me to launch my own skin care line, Park Perfection.

I spent 5 years talking to thousands of DermWarehouse customers about what they wanted (and expected) in their skin care products. This gave me some real insight into what people would want to see in a new brand. When I first started Park Perfection, even with all that I had learned from DermWarehouse, I quickly realized creating your own product and launching your own brand was a different ball game.

I learned every step of how to start an eCommerce beauty brand by getting my hands dirty and going through it myself. From product development and creation to finding and working with vendors for packaging to branding to website development to marketing and PR, there was a lot of trial and error to get to a place where I felt confident in the whole process. Now that I’m at that place, I want to share what I know with you.

Table Of Contents

Note: You can jump-skip to each respective section by clicking on the hyperlink in the table of contents.

-

-

Whether you acquire a product that’s already been developed, create your product from scratch, or go the private label route, the key to success is finding a great product that works well and that your customers trust.

-

-

-

How do you develop a beauty product from scratch? From working with the lab to product testing and more, there’s a lot of steps involved.

-

An alternative route versus creating a product from scratch is to acquire a product that’s already been developed. This doesn’t have to be expensive. I’ll walk you through ideas on how to approach this.

-

-

-

There’s a lot that goes into the packaging of each product. From finding vendors to package design to coordinating all of the logistics involved, finding the perfect packaging can be challenging.

-

-

-

What’s the ballpark price to launch your very first beauty product? While everyone’s scenario is different and costs can vary, I’ll let you know how much it cost me to launch our very first product. I wish I had this information heading into our product development journey so I’m excited to share this with you.

-

-

-

Learn how we came up with the name Park Perfection and what you should take into consideration when it comes to branding, color scheme and logo design.

-

Think about how you’re positioning your product and make sure your verbiage on the package follows each and every requirement.

-

-

-

Your eCommerce site doesn’t have to be overly complex but it needs to showcase your product in a memorable way.

-

How are you going to acquire customers? Marketing is one of the most important aspects when it comes to your eCommerce beauty store succeeding. Will your top channel be Social Media, Google or Amazon?

-

-

-

We had a huge PR win that catapulted our brand. I’m going to share this with you to understand the importance of PR to solidify your brand. This, in turn, can generate more sales.

-

-

-

Find out how we grew so quickly within 12-months by leveraging our other business, DermWarehouse. It’s important to make connections with other stores and outlets!

-

-

-

I’m going to let you know what you need to do next to get started launching your very own eCommerce skincare brand!

-

Finding a Great Product

The first and most important step to launching your eCommerce beauty brand is developing a great product. You can have an amazing website, beautiful branding, and amazing marketing, but if your product sucks, people aren’t going to buy it. Or, maybe they’ll buy it once (thanks to your stellar marketing skills), but chances are, they won’t come back to purchase it again (and repeat business is what your ultimate goal should be!).

Making sure your product is great from the get-go is worth investing time into because at the end of the day, this is going to be the deciding factor in whether your business fails or succeeds.

Starting from Scratch

First let’s talk about developing the product yourself. Assuming you’re not a chemist, you’ll need to find a lab to work with to help you create and then manufacture the formula. We’ve had great success with our manufacturer and they’ve done an amazing job of bringing our visions to life. The key here though is that the vision must be yours. Make sure you come in with a very strong idea of what you want your product to accomplish, feel like, smell like, etc.

Whenever we’re ready to create a new product, we put together a product profile. This includes detailed information about what we want the product to do and any key ingredients we would like it to include. The product profile is extremely important, as this is what relays your vision to your manufacturer. Again, they can’t do this part for you!

Once the lab puts the initial formula together, you’ll need to do product testing. The amount of testing required will depend on what type of product you’re creating. Our first product, Instant Eye Lift, works instantly to lift and tighten the area around the eyes. We were able to feel the consistency of the product and see the results immediately. We didn’t get the formula nailed down on our first try, but once we had it, we had it.

Our second product was an eyelash enhancing serum. We had to test this product for 2-3 months to make sure it worked how we wanted it to and that the results were there. In the first round, the product didn’t perform exactly how we wanted, so we went back to the drawing board and adjusted the formula. After that it was another 2-3 months of testing to make sure it worked how we wanted. When you’re putting together your timeline for product launch, make sure you account for this extra time. Once you’ve signed off on your formula, the lab will need all of your packaging materials before they actually start manufacturing the product (more on packaging below).

Acquiring a Brand That Already Exists

The second option for finding your product is acquiring one that already exists. This makes sense if there’s a great product or line out there that you know of and you come across an opportunity to acquire it. There are plenty of brands that go out of business or decide to discontinue their lines, so it’s just a matter of finding the right one if this is the route you decide to take. BizBuy Sell is the internets largest business for sale marketplace. This is a good place to start. Doing research yourself and reaching out to brands eliminates competition in bidding for a business.

This can be a great option because you can eliminate the product development process and either rebrand the product to make it your own or if the branding is already great, you can take it over and go from there. This could mean you already have some loyal customers, social media following, and brand assets.

One way or another, whether you’re developing the product yourself or acquiring it from someone else, you need to make sure the product is great (I can’t stress this enough). Have as many people test the product as possible to tell you their thoughts and then make sure to listen to the feedback you’re getting, as this can help avoid product issues down the road. For your eCommerce business to be successful, repeat orders is going to be crucial. Don’t rush into creating and marketing a product until you know it’s great.

Packaging

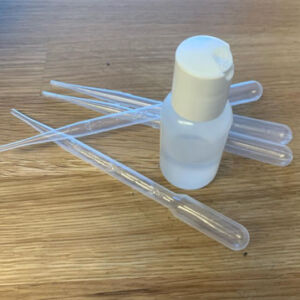

For me, figuring out packaging has been one of the most difficult parts of starting my own skin care line. During the first two years of launching Park Perfection, I had a different vendor for boxes, bottles, and samples. It wasn’t until recently that I found a one-stop shop for this (thank heavens). Below were some difficulties during my process in trying to find the right partners:

- For the box vendor, they had to be be able to custom make a box in any size we wanted.

- We needed to find a vendor that specialized in samples. Sending out samples was a big part of our marketing strategy.

- The bottles have been the most difficult part for us. One vendor carries great airless pumps. We have another vendor that was able to get us several other bottle types, but they didn’t have much in the way of cleansers. Finding the bottle for our eyelash serum took us about 6 months!

Once you find the vendors you’re going to use for the bottles, you need to get die lines, create artwork for the bottles (more on this below), and coordinate the bottles to be shipped to the manufacturer. The manufacturer won’t start making your product until all of the components are on site (this makes sense, as they need everything there to fill and pack up for you).

The logistics of coordinating all the different vendors can be difficult. Make sure you’re staying organized with this as there’s a lot of moving pieces. It’s also important to keep in mind the cost minimum involved (more on this below).

Not only does the packaging showcase your brand’s identity, it also has to function properly to give your customers the best experience using your product. We ran into an issue with our first run of Instant Eye Lift where the product wasn’t pumping properly. A lot of our customers were loving the product but having issues with the bottle, which was a deterrent in them re-ordering from us. We did a lot of research into alternate packaging and once we found the perfect bottle, the overall customer experience improved immensely!

It’s also a great idea to think about what your unboxing experience will look like. Every step of the way, you should be thinking about how to make the experience with your brand a memorable one.

Your packaging experience is an extremely important one, so while it’s not always easy to find the perfect packaging, it’s worth being picky.

Costs

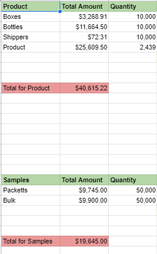

When my family first decided to launch Park Perfection, I had no idea what the cost of developing a product would be and what goes into it. Between the product itself, the bottles, the boxes, and then samples if you decide to invest in them (which I highly recommend), product development isn’t cheap. There’s no better way for me to explain this than to just show you what our cost was for our last run of Park Perfection Instant Eye Lift (see below).

We’ve done several runs of the product by now and the most important thing we did at the very beginning was to make sure we found vendors who didn’t require large minimum order quantities. We were able to order 5k boxes and bottles (in the image below, we had to order 10k of each). Our first run of the product itself was for 850 products. Our manufacturer held onto our extra boxes and bottles and we were able to use those down the line once we ran out of our first batch of products. NOTE: This made the next few batches much cheaper as we already had those ready to go.). Our very first run of our first product was around $25k. The price below has increased because of the larger quantities that we’re ordering, however, we’re also getting better pricing now because of this.

You’ll see in the image below that we also ordered samples. The packets are the packaging for the samples and the bulk is the product that goes into the samples.

As you can see, developing a product is a pretty large investment so this is something you need to be prepared for.

Branding

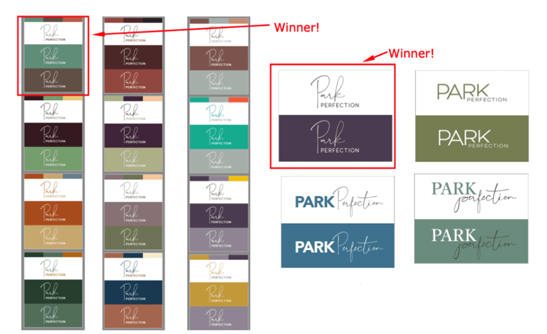

Branding is a huge part of starting your own skin care line. First, you need to pick your brand name. My brother, Jason, the Owner of The Media Captain, actually came up with Park Perfection for us and it works perfectly (see what I did there!). The name includes our family’s name and something everyone wants to feel after they apply their skin care products: PERFECT! You can read more about the whole Park Perfection story HERE!

When it came to picking our product names, however, we have been much more strategic. We made sure to include the product’s function in the product name, as we knew this is what people would be searching for on Google or Amazon when looking for a product, which is beneficial for search engine optimization and Amazon Marketing. For example, our eye cream is called “Instant Eye Lift.” Our eyelash serum is called “Lash Enhancing Serum.” Customers will know exactly what the product does just by reading the name.

We were very lucky to work with TMC’s amazing graphic design team to help bring our vision to life when it came to our branding. I tried to be as specific as possible when verbalizing my vision for the brand. I wanted something elegant and luxurious, but not too feminine (the product works great for men too!). After deciding on our name, the TMC team helped us create a logo, pick a color scheme, and design all of our product packaging.

The verbiage you use when describing your product and your brand is very important as well. I make sure to fully understand all the ingredients that go into our products so I can explain the benefits and how the product works to customers.

Important note: There are a lot of requirements when it comes to the claims your product makes. There are wording restrictions, for example, you can’t say “Park Perfection Instant Eye Lift removes wrinkles.” You can say, however, “Park Perfection Instant Eye Lift diminishes the appearance of wrinkles.” Our manufacturer has someone on their staff who has to approve all of our packaging to make sure it’s meeting the requirements before it goes into production.

Web Design

If you’re planning to sell your product online, you’ll need an eCommerce website. Shopify is a popular eCommerce platform and will allow you to do a lot of the work in building the site yourself. We use WooCommerce for our eCommerce site for both Park Perfection and DermWarehouse. WooCommerce gives us the ability for more customization on our site, but has also required a developer to help us. I can’t stress enough the importance of a strong website to showcase the brand you’ve worked so hard to create. You don’t need to make your site overly complex, but you do want to make sure you’re showcasing your brand in the best possible way.

Marketing

Marketing is one of the most important aspects when it comes to your eCommerce beauty store succeeding. For most, you’ll need to do a lot of work to acquire customers. We’ve experimented quite often when it comes to our marketing. We were also fortunate that we were able to market our product, Park Perfection, to all of our DermWarehouse customers (more on that below!).

If you’re starting a brand from scratch, paid ads on social media are usually a good place to start. Make sure you have great visuals to showcase your product (videos would be even better!). This way potential customers can see the product and the product benefits, which will entice them to purchase your product.

Google is also a great channel with strong intent as your potential customer would be searching for queries related to your product. Your eCommerce business can invest in Google Shopping or Google PPC to see which one performs better. Typically, you’ll find a top converting channel for your eCommerce business between Facebook vs. Google.

[learn more about Facebook vs. Google for advertising and what’s best for your biz]

Amazon is also a great channel to get started on. In fact, I’d say it’s a must and will help you reach a whole other group of customers. It can take some time to get approval on Amazon in the skin care category, so that’s something to prepare for. They will require certain information on your packaging in the photos, a certificate of analysis from the manufacturer, and an invoice showing your purchase order as well (just to name a few of the requirements).

Public Relations

As you’re ramping up your marketing, it’s important to also have a great PR strategy in place as well. You want to get the word out there about your product and getting a mention in a well-known publication will not only do huge things for your sales, but it will also greatly help enhance your reputation.

I have spent countless hours researching and reaching out to reporters. The key here is to come up with a memorable way to grab their attention (think about how many emails they must get to try out new products) and then make sure to follow up. There have been very few people who have gotten back to me on my first try. Make sure you’re organized with your outreach so you can keep track of when to follow up and with who. I use a combination of HubSpot and Monday.com to keep track of this and make sure the follow ups are consistent. And, it got Park Perfection an amazing feature review in InStyle Magazine, so I must be doing something right! This article generated hundreds of sales for us and has been an amazing piece of marketing collateral for us to use.

When you start a skincare brand, it’s your baby. That passion will be seen by reporters and journalists when you’re seeking a big PR win.

Leveraging Different Channels

Earlier, I alluded to the fact that DermWarehouse has been a great resource for us. We were very lucky to have this other business with hundreds of thousands of customers where we could market our product. We’d spent 5 years building relationships and trust with our DW customers, so when we launched Park Perfection and made an announcement, so many people were interested in trying our new product. We continued to garner interest by sending samples and marketing materials in every single DermWarehouse package. As you saw earlier, samples aren’t cheap, but sending these out to our customers has been so worth it. It’s because of this that in one year, Park Perfection Instant Eye Lift became one of our top 5 selling products on our entire site (and we sell over 2,000 SKUs).

Getting up and running on your own site is the first step, but you can’t stop there. Next, make sure you’re selling on Amazon to leverage an entirely new customer base. Then it’s time to start making connections with other stores (eCommerce or Brick and Mortar or both!) to continue growing your customer base, your brand name, and your sales.

At this point, you’ll probably also start running into unauthorized sellers of your product popping up. We’re starting to experience this now and it’s something that we’ll be constantly monitoring moving forward.

In Closing

As you can see, starting an eCommerce beauty brand is no cake walk. There’s a ton that goes into this, from product development to packaging to branding and more, plus the up front costs are significant. If you have an awesome product and you can get through these steps, skin care and beauty is an amazing industry to be in, and one that continues to grow.